The IRS announced the standard mileage rates for 2015. , oops, 2016. You can find the official announcement in Notice 2016-01.

According to the IRS comments in IR-2015-137: (more…)

Nonprofit finance, accounting, and tax news. Other tidbits of interest to the charity community.

The IRS announced the standard mileage rates for 2015. , oops, 2016. You can find the official announcement in Notice 2016-01.

According to the IRS comments in IR-2015-137: (more…)

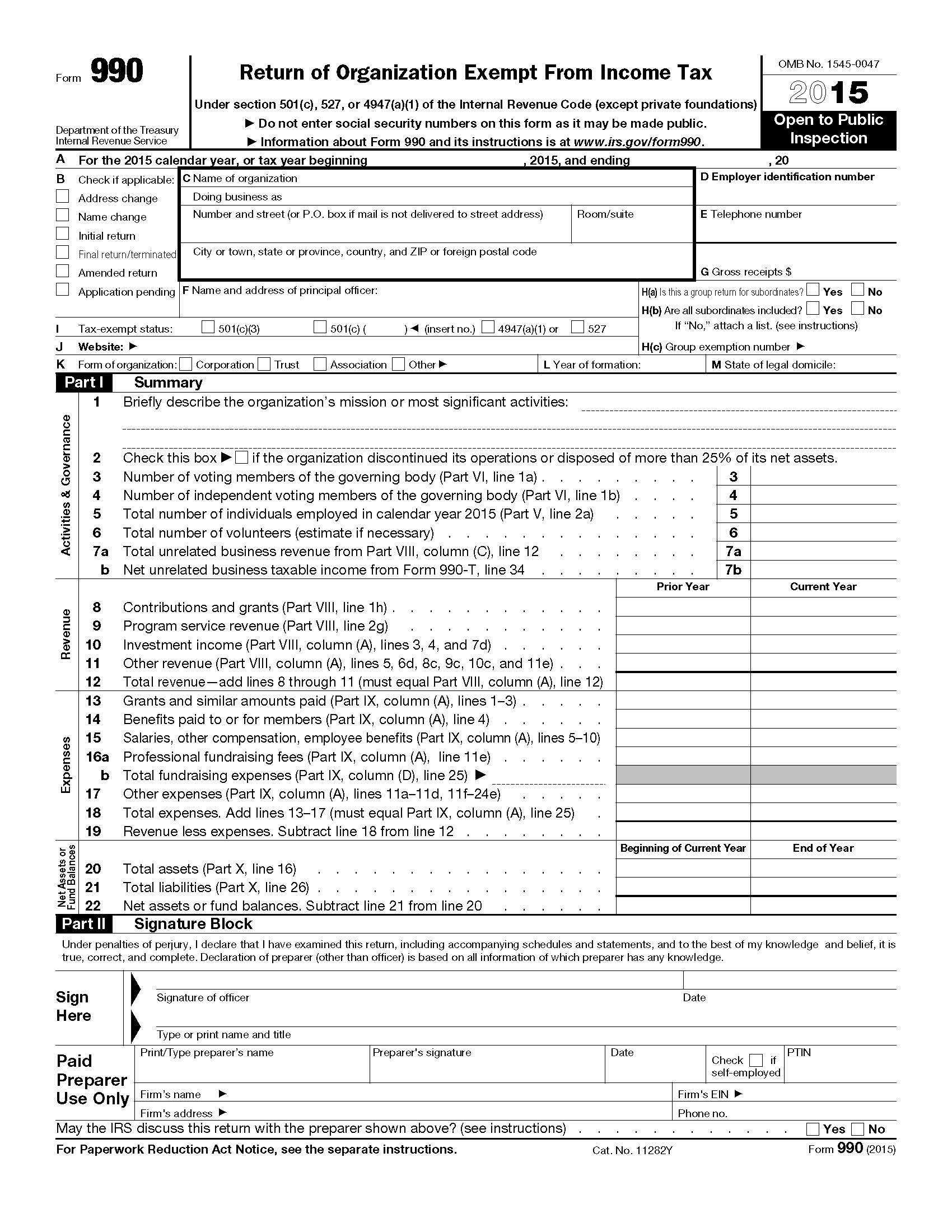

Sometimes there is a perception in the charity community that those pesky filings with the charity regulators are no big deal. Sometimes board members don’t pay much attention to the 990.

Well, last week the California AG sued one charity in the state for allegedly misleading information in the RRF-1. That is a simple one-page form that has only two numbers: total revenue and total assets. The AG claims the 990s have misleading information in them.

How can the AG of a state sue over a tax return filed with the federal government? Here is the path they take. They allege the one page RFF-1 was misleading because attached to the RRF-1 is the federal 990, which is where they find the information that they consider to be misleading. That gives the state grounds to sue.

The sobering lesson for CPAs who serve the charity community is the AG also sued the CPA firm. In addition, they sued the audit partner personally.

Elaine Sommerville, CPA, explains The Two Most Confusing Aspects of Classifying Your Minister for Tax Purposes at Church Law & Tax.

A frequent source of confusion for handling ministers’compensation is Social Security and Medicare taxes. Federal law defines ministers of the gospel as being subject to the Employed Contributions Act (SECA) instead of the Federal Insurance Contributions Act (FICA), which is what all of us are most familiar with. The SECA rules usually come into play for self-employed people.

If you, or your ministry or business, own an overseas financial account, you are required to file an FBAR annually. This is also called a Report of Foreign Bank and Financial Accounts, or Form 114. This would also include accounts for which you have signature authority.

A 21 page e-book, Protecting our Ministry with Integrity, is available from Church Law & Tax, which is the writing platform for Richard Hammar. If you are new to leadership in the church world, he is one of the leading writers on legal issues in the community.

At the price of signing up for future sales pitches (when you consider the quality of the resources available, that is a really low cost), you can read about: (more…)

If you are using a credit card reader in your church, time to get a new one. A tool to help with setting up timelines for document retention. Also, pastors, please guard your heart.

Guard your heart

To all the dear pastors devoting your life to leading us sheep: Guard your heart.

6/21 – Christianity Today – Tullian Tchividjian Resigns after Admitting ‘Inappropriate Relationship’

Guard your heart. Please.

Get new credit card reader before October 1

The IRS took serious exception to the methodology used by Food for the Hungry in preparing its tax return for the fiscal year ending September 30, 2008. The IRS audit of that 990 ran for years.

On March 24, 2014, the ministry announced the IRS closed their audit. The ministry says it did not have to file an amended return but did agree to change the way that it was accounting for gifts in kind.

A summary of the issues as I described them on 6/3/14:

Now that tax returns are available through the 2014 fiscal year, we can see enough 990s to develop a case study about how much it costs to respond to a major challenge from the IRS.

Why the big deal?

The June 30 deadline is rapidly approaching to file the FBAR reports for overseas bank accounts on which you have signature authority when the account holds $10,000 or more at any time during the year.

For mission organizations, think about those checking accounts you have in the field used to fund your local activities. If those accounts have more than $10,000 in them at any point during the year your organization has a filing requirement.

If you are in the finance area and have signature authority on one of those accounts, you personally have a filing requirement.

There’s no extension for the deadline. The penalties could get nasty.

Kelly Phillips Erb provides a great summary: IRS Issues Reminder As Taxpayers Near Deadline To Report Foreign Accounts, Assets.

Here is her technical summary:

Here are a few articles on my growing backlog of ideas of interest to charities. Quick updates on a variety of topics: general reminders, maintain control over funds sent overseas, FICA taxes on 403(b) contribution, short list of regs impacting a missionary sending church, and cell phones as de minimis fringe benefit.

12/10/14 – Ministry CPA – 5 Reminders about Charitable Contributions – Check out the article for quick summary of: (more…)

There is a lot more to say on the FTC and all AGs going after four charities that were way out of line.

5/19 – William P. Barrett at Forbes – Cancer Charities Agree to Dissolve Amid Fraud Claims – Article summarizes the case by the FTC. Two of the four charities have agreed to close their doors. Three of the named individuals have agreed they will not have future involvement with charity management or even fundraising.

We did nothing wrong and we agree not to break the law again

Article points out the irony we seen these kinds of settlements. Even though the three individuals agreed to not be involved in the charity sector again during their lifetime and two of the charities agreed to be taken over by receivers and then liquidated, the charities and individuals involved denied doing anything wrong.

It is as if it’s a normal and everyday thing that individuals agree to be legally barred from involvement in their economic sector and charities agree to corporate suicide when they have done nothing wrong.

But that’s the legal dance that is necessary. Denying wrongdoing is necessary to prevent the consent degree from becoming proof to anyone who later tried to sue the charities or individuals. Even though I understand the reason, it seems silly to those looking in from the outside.

Contested claims

Articles on warning signs that a charity’s financial processes aren’t working well, the debate on DAFs, and a way-out-there charity.

4/10 – GuideStar – Ten Signs of Financial Trouble for Board Members – If you are on the board of a larger-sized charity, might be helpful to check out this list of warning signs that something is wrong in the financial function. Applies to any charity in New York.

Just a few tidbits:

1.FINANCIAL INFORMATION IS LATE–

More good stuff is my way of pulling together articles that are worth discussing just won’t get a full post by themselves. I’ve done that previously on this blog with the overhead ratio issue. Will start doing the same thing with general nonprofit articles.

So, here are a few quick reads for background: why churches struggle to grow past certain levels, and some info on filing 990s.

3/25 – Thom Rainer – One Key Reason Most Churches Do Not Exceed 350 in Average Attendance – Here is some info on the size of typical churches in the U.S.: (more…)

About a week ago I renewed the fictitious business name used for my publishing projects. Paid San Bernardino county $55. Only reason it took 20 minutes to prepare it is that the county revised the form since my last filing. Since I’m a cautious accountant, it was obviously necessary to read all the instructions just to make sure nothing changed.

Also received an invoice in the mail today that looks like it is from the Fictitious Business Name office reminding me the FBN is about to expire and the fee will be only $150.

Hmm. The form I just filed said the fee was $55.

If you look carefully, the outside envelope and “invoice” both contain one statement each saying this is not an official government request.

If your ministry has old payroll checks or old payments to vendors that have never cleared your checking account and you can’t find the employee or vendor, at some point in time you need to turn that money over the State of California. I think there are similar laws in most states.

I’m guessing you may not have realized that. I’ll make another guess that you aren’t alone.

Just read a background article on the issue, which is referred to as escheat. I learned there is a 12% annual penalty on any amounts that should have been turned over to the state but were not.

Since I’m making lots of guesses, here’s another one. As hungry as the state is for tax revenue, we may someday see auditors from the State Controller’s Office start looking for money from businesses and charities that haven’t escheated funds. Twelve percent over three or four years could add up to some decent return on an auditor’s time.

You remember that old question about what to do with those old outstanding checks that haven’t cleared?

Writing them off doesn’t work as the answer anymore. Those outstanding checks belong to somebody else.

The correct answer is look again for the payee and then after the proper time runs (3 years according to the article), you should start the specified two-step process and eventually get the money to the Controller’s Office.

A word to the wise is sufficient. Remember to render under Caesar what is Caesar’s. Since we are talking about money you intended to pay someone, consider that the laborer is worthy of his wage even if you don’t know his current address.

Following article appeared in the California Board of Accountancy’s newsletter Update #77 and is reprinted with permission of the California State Controller’s Office and the California Board of Accountancy.

(For ease of reading, this will not be posted with quotes around the whole article.)

CPAS CAN HELP CLIENTS MEET UNCLAIMED PROPERTY REPORTING REQUIREMENTS

Written by the State Controller’s Office for use by the California Board of Accountancy

Do you have clients who are holding unclaimed property? Perhaps it is a returned security deposit or refund check. Or, it could be stocks, bonds, safe deposit box contents, or other property. With $7.6 billion in unclaimed property received by the State Controller’s Office (SCO) and an estimated 28.6 million owner accounts available to be claimed, chances are, you may have clients who need your guidance in this area.

The Evangelical Council for Financial Accountability is offering a free one-hour Healthcare Update for Small Churches and Ministries on February 12, 2015 at 1 pm EDT / 10 am PDT.

From the ECFA website: (more…)