Unless there is a religious exemption in an area of employment law, religious charities are required to follow all the rules and regulations that apply to businesses.

3/8 – CPA Practice Advisor – 6 HR Must-Knows for Small Businesses in 2016 – These “must-knows” apply to churches and parachurch ministries just as much as small businesses. If you’re not familiar with these issues, your organization could trip over the rules and create big problems.

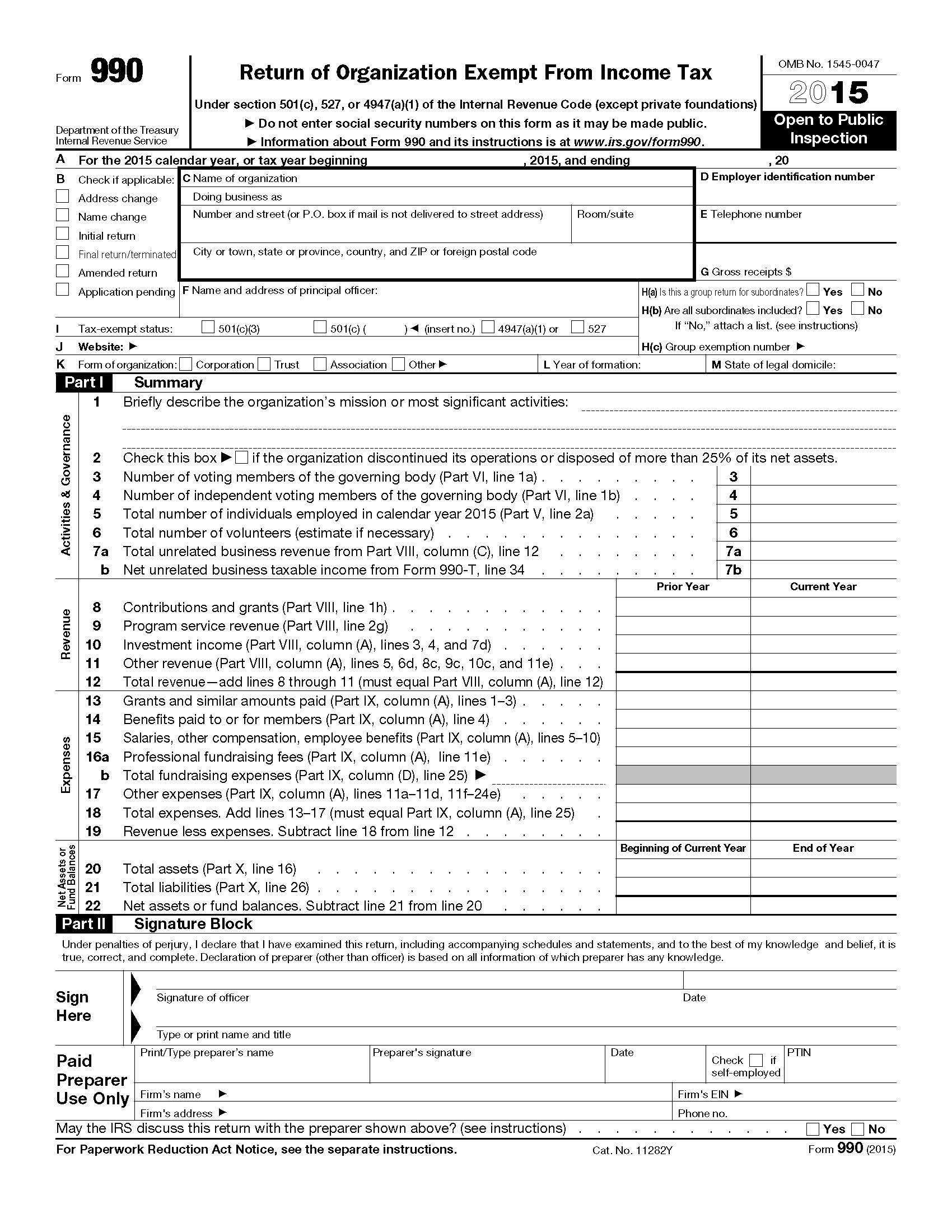

The issues described in the article and my brief comment: