For today’s lineup we have Claire Knowlton arguing charities should be funded for the full cost of their operations (including building cash reserves, additional reserves for new opportunities, and repaying debt) in order to remain healthy versus Ruth McCambridge and Alexis Buchanan body slamming Wounded Warrior Project because one line item on the 990 is more than what a couple of media reporters decided it should have been.

Let’s check out the NPQ versus NPQ match:

In this corner…

1/25 – Claire Knowlton at Nonprofit Quarterly – Why Funding Overhead Is Not the Real Issue: The Case to Cover Full Costs – In order to be able to continue delivering services to clients, charities need to be healthy enough that they can pay all their bills and have the ability to respond to opportunities.

Author suggests grants to charities should cover all of their costs, not just the immediate program under discussion in a proposal. Author introduces a new term, full cost, which is:

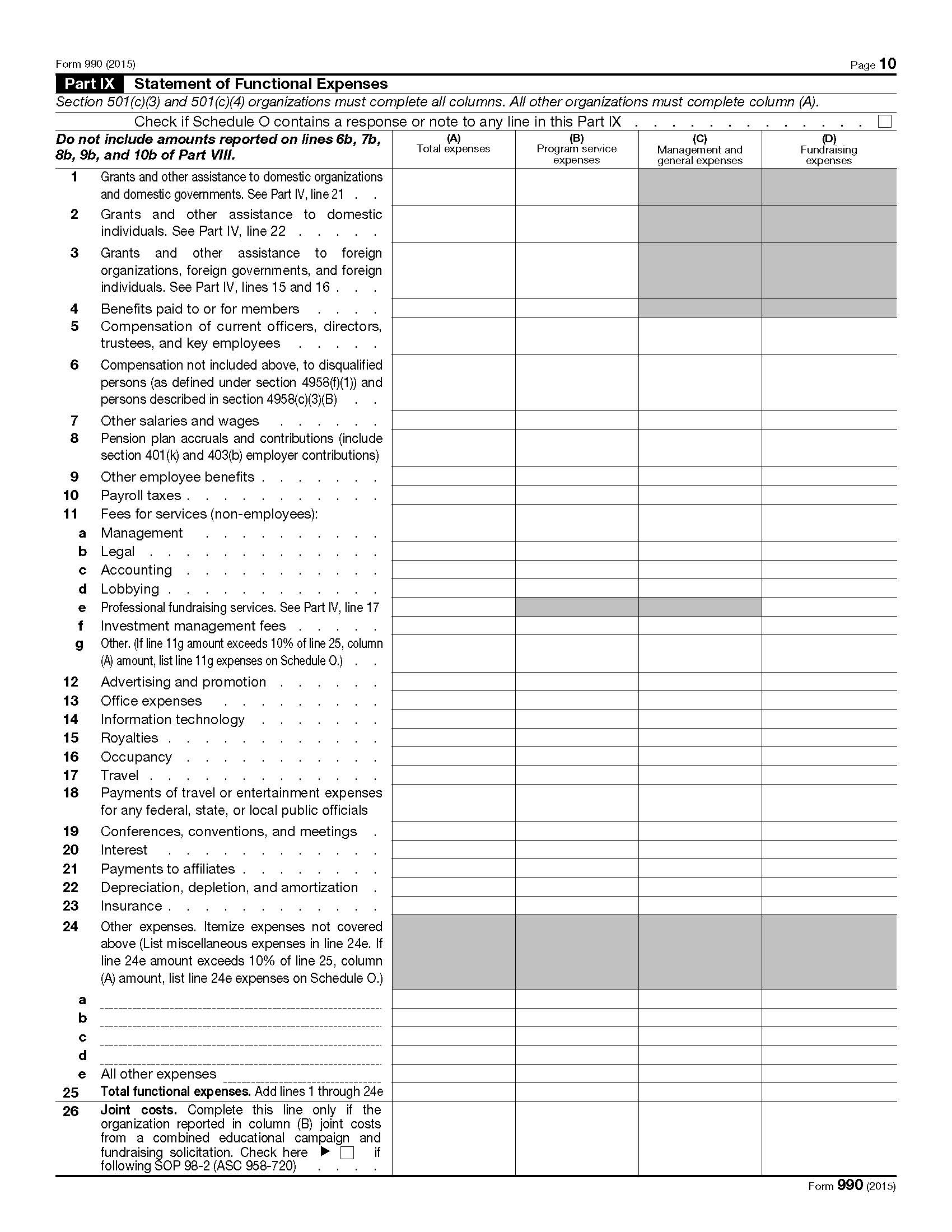

Day-to-day operating expenses + working capital + reserves + fixed asset additions + debt principal repayment = full costs