Major news yesterday was the CEO and COO of Wounded Warrior Project getting fired by the board of directors. Here are a few articles on the story. Also, my rant on the long-running pattern of media articles that focus on trivialities.

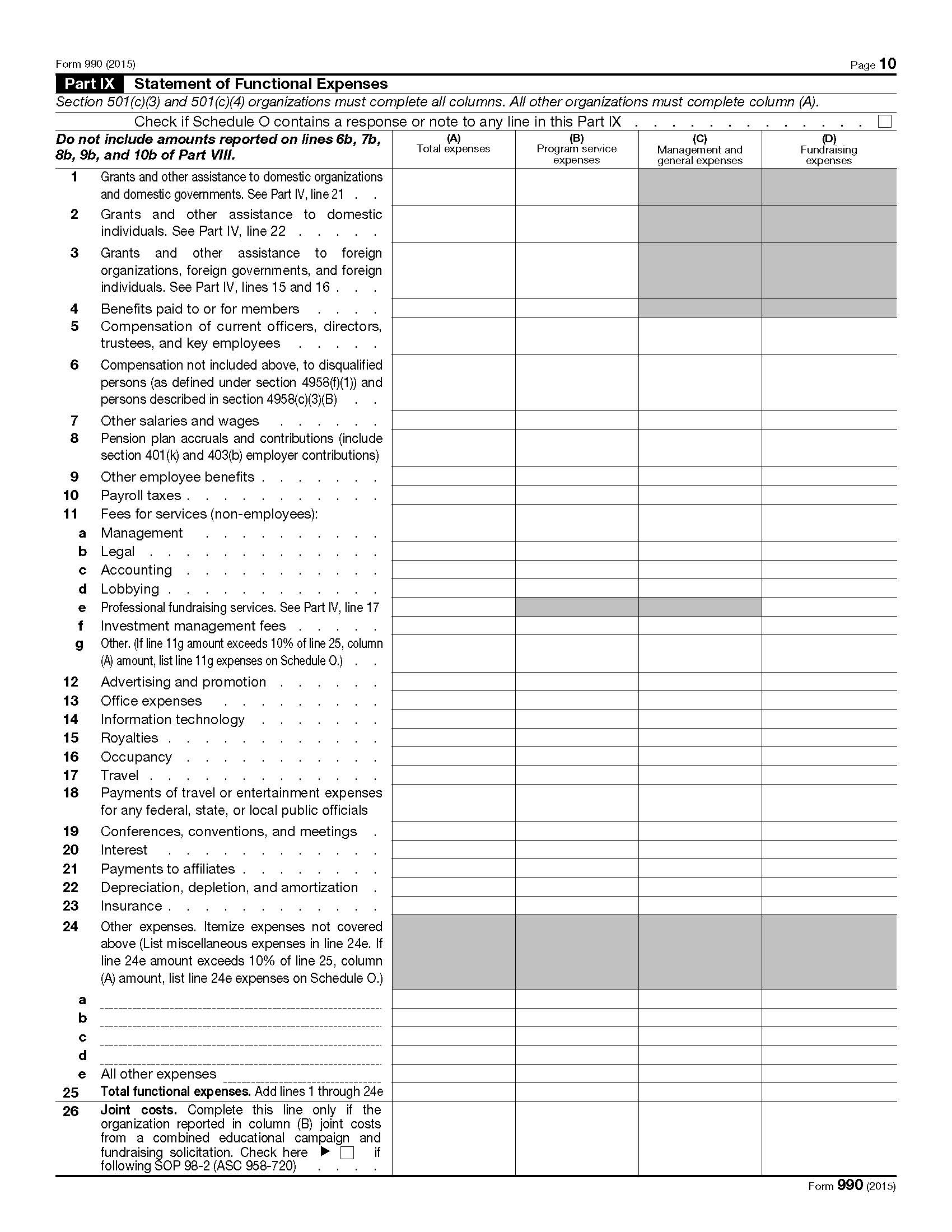

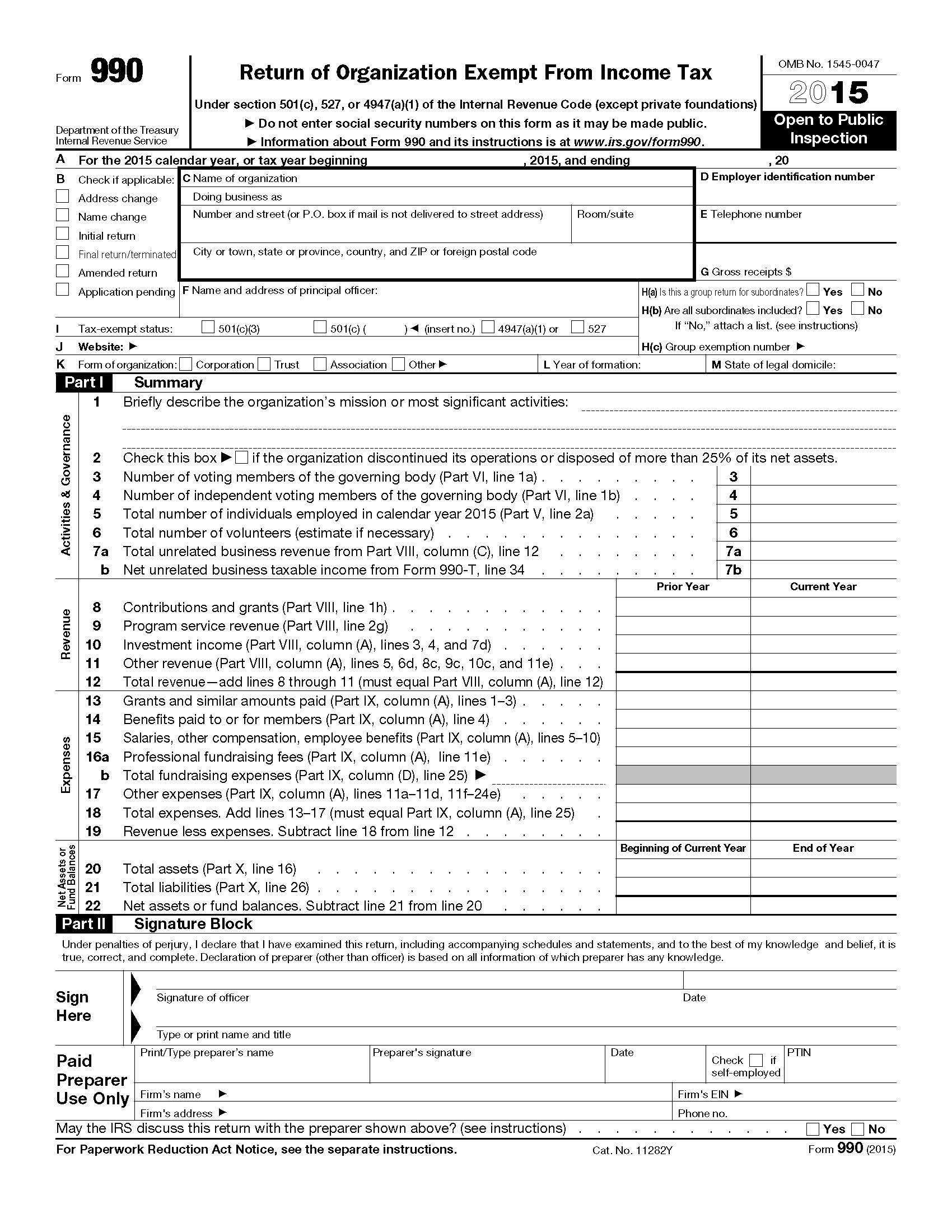

3/10 – CBS News – Wounded Warrior Project execs fired – CBS is reporting that on 3/10 WWP fired Steven Nardizzi, CEO, and Al Diordano, COO. CBS reports preliminary results from a financial audit have been received and reviewed by the board.

3/10 – Chronicle of Philanthropy – Wounded Warrior Project Fires Top Officials After Query Into Spending Practices – Article points to CBS coverage above. The board initiated a financial and policy audit.

In the hour since CBS broke the story, I saw several dozen articles hit the ‘net that report the story with merely a rewrite of the CBS coverage.

3/10 – Wounded Warrior Project – Board of Directors of Wounded Warrior Project Addresses Independent Review – Very tactful press release says the CEO and COO are no longer with the organization.

The independent review refuted the headline accusations against the organization and tactfully found room for improvement.