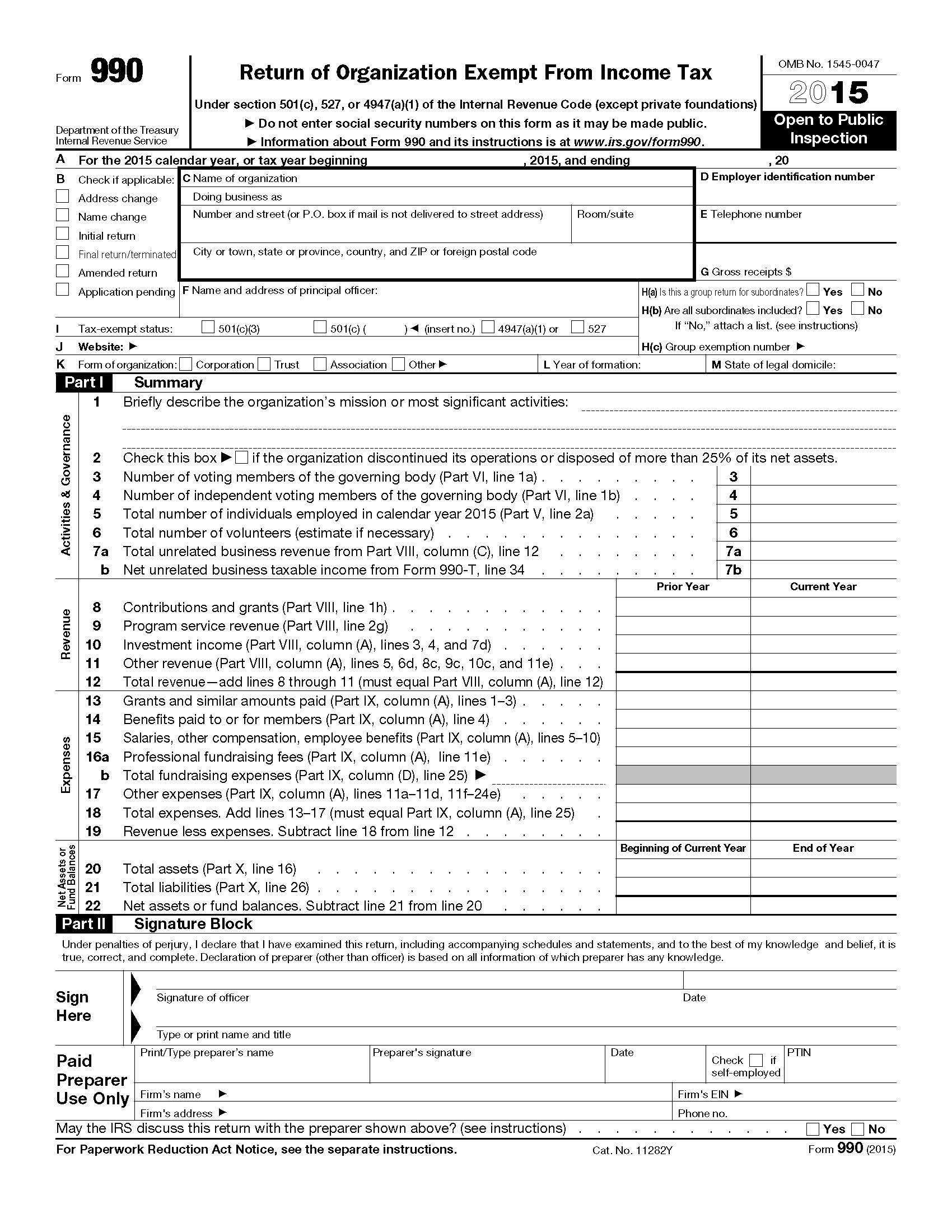

Sometimes there is a perception in the charity community that those pesky filings with the charity regulators are no big deal. Sometimes board members don’t pay much attention to the 990.

Well, last week the California AG sued one charity in the state for allegedly misleading information in the RRF-1. That is a simple one-page form that has only two numbers: total revenue and total assets. The AG claims the 990s have misleading information in them.

How can the AG of a state sue over a tax return filed with the federal government? Here is the path they take. They allege the one page RFF-1 was misleading because attached to the RRF-1 is the federal 990, which is where they find the information that they consider to be misleading. That gives the state grounds to sue.

The sobering lesson for CPAs who serve the charity community is the AG also sued the CPA firm. In addition, they sued the audit partner personally.

An oversummarized description of the accusations is that the AG alleges a material portion of advertising and other costs were classified as grants. That’s their claim.

The second cause of action in the lawsuit alleges both the firm and the partner were aiding and abetting the charity’s breach of fiduciary duty. The AG would like to put the firm and the partner on the hook for what the AG claims is misleading information in the tax returns.

Oh, the suit also alleges the partner and firm are responsible for the incorrect information in the audit report. So the lawsuit is alleging the state RRF-1, federal 990, and audited financial statements are all misleading.

My discussion of this case can be found at my other blog, Attestation Update:

- Misbehavin’ clients. Misbehavin’ CPAs. Part 1.

- Misbehavin’ clients. Misbehavin’ CPAs. Part 2.

- Misbehavin’ clients. Misbehavin’ CPAs. Part 3.

After you read my summary of the situation, you will likely think the alleged behavior (if it is even actually true) is light years removed from how you prepare your 990. If you are attentive enough to accountability issues that you have read this far in a post on my blog, you are almost certainly correct.

There is still a very strong warning here for anyone willing to pay attention: internal accounting staff of a charity and the charity’s outside accountants all need to do good work. Pay attention to your 990.

It is actually possible to get in trouble with the California AG over your RRF-1 and 990.